In such instances tax residents will be exempted from paying personal income tax in Malaysia. SST Return Submission and Payment.

Flowchart Final Income Tax Download Scientific Diagram

Capital allowances consist of an initial allowance and annual allowance.

. Tax Offences And. CP204 Due Date of the Submission. All business decisions today have tax implications and it is important for a company to manage its income tax requirements efficiently.

In general tax of a non-resident company on all income other than income from a business source is collected by. By using the prescribed form CP204. By PropertyGuru Editorial Team.

The system is thus based on the taxpayers ability to pay. Following the announcement made by MOF on 30 December 2021 the following Exemption Orders have been gazetted on 19 July 2022. According to Section 831A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that employee on or before the last day of February in the year immediately following the first.

SST Registration in Malaysia. The IRB is fully in their right to fine 100 of the undercharged tax. After the return submission in the same portal the payment is made via FPX facility with 17 banks to choose from.

What are the Income Tax Taxation Slabs. Income tax forms of management account - Form CPPTBM. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

However Schedule 3 of the Income Tax Act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

What is the Proper Way to Submit the Tax Payable Estimation. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Whereas the category of non-residents individuals companies etc still remain eligible for income tax exemption. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30.

Introduction Individual Income Tax. Most of the hassle bustle is based on the submission of various insurances and rent receipt. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so.

If the income tax submission is filed late it may. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. Goods and Person Exempted from Sales Tax.

With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax. The recommended form of the first submission is Form CP204 and revising the Form CP204A initial submission. You can do so under the Statutory income from rents when making an online submission.

At 3E Accounting Malaysia we work closely with you to identify tax strategies that work best within your organisation and manage your tax compliance. Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. Rental Income Tax Malaysia And Other Tax Reliefs For YA 2021.

Once you do you will be asked to sign the submission by providing your identification number and MyTax password. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. The freelance calculate income tax shows the values as per these tax rates only.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. It may seem intimidating to use e-Filing form at first but it really is easy to do.

The same taxation slabs apply to the freelancing individuals as well. 5 Order 2022 Exemption of FSI received by resident individuals. The tax estimation submission in Malaysia under Section 107C of the Malaysian Income Tax Act 1967.

And part B2 in the BE form or part B7 in the B form when making a manual submission. Income Tax Exemption No. Submission deadline for CP204.

The balance of tax payable by a company based on the return submitted is due to be paid by the due date for submission of the return. Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C. But if you want to save on taxes and safe.

The income tax return verification will be displayed on the screen on the successful submission. Download the ITR-V form from the link displayed sign it and submit it to the. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8.

Incomes up to Rs 25 lakhs are not taxed upon income between the values 25 lakhs to 5 lakhs are taxed 10 5 to 10 lakhs 20 and above 10 lakhs 30. Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990. A company is tax resident in Malaysia if its management and control are exercised in Malaysia.

How To Pay Your Income Tax In Malaysia. Malaysia Personal Income Tax Rate. E-Filing For Income Tax Starts On 1 March 2021 LHDN Inland Revenue Board has recently released the Return Form RF Filing Programme For The Year 2021 on its website which listed all the file types due dates grace period and filing method for your references.

21 July 2021 New submission deadline for Form P B extended from 15 July to 31 Aug 2021. Find out everything you need to know about SST in Malaysia as a small business owner. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Form EA is a Yearly Remuneration Statement prepared by the company to employees for tax submission. SST Penalties and Offences in Malaysia. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of.

Return Form RF Filing Programme. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year. If the company is starting up for the first time the assessment must be filed with the IRB within 3 months from the starting date of their operations but not 30 days before the start of the base period.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified. Filing a tax assessment in Malaysia is compulsory under section 107C of the Malaysian Income Tax Act 1967.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts.

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Softw Hr Management Payroll Software Human Resources

What Is Local Income Tax Types States With Local Income Tax More

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Flipkart Seller Hub Integration With Gst Accounting Software Eztax Accounting Software Accounting Create Invoice

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Individual Income Tax In Malaysia For Expatriates

Yc Backed Cleartax Embarks Upon India S Fast Growing Online Tax Filing Market Http Tropicalpost Com Yc Backed Cleartax Emb Filing Taxes Online Taxes Start Up

Seeing Number Of Gst Notices To Collect Outstanding Gst Directly From Bank Accounts Applies To Ecomm Operators Accounting Tax Services Accounting Software

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

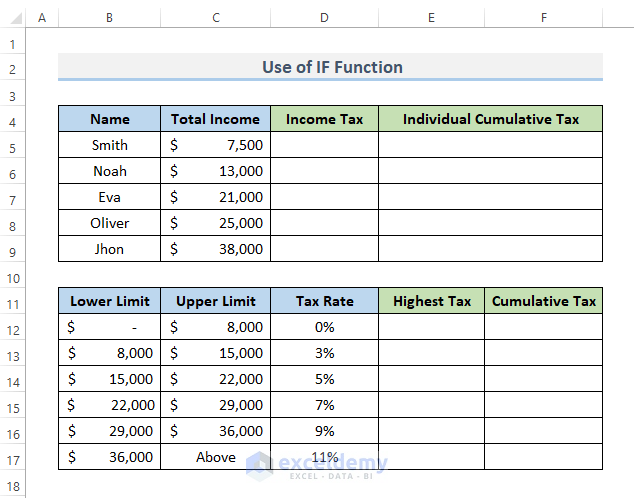

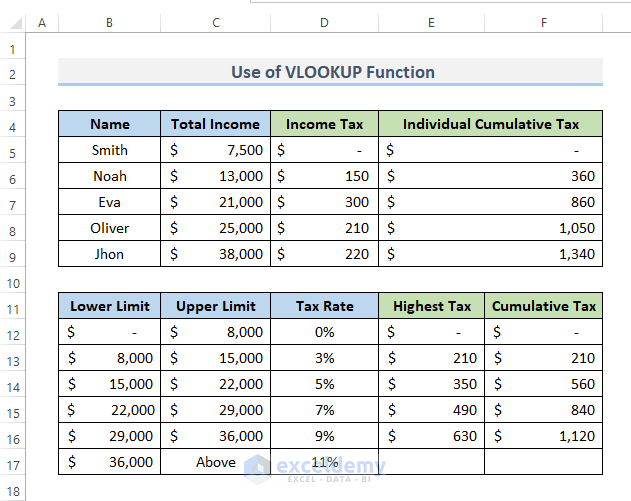

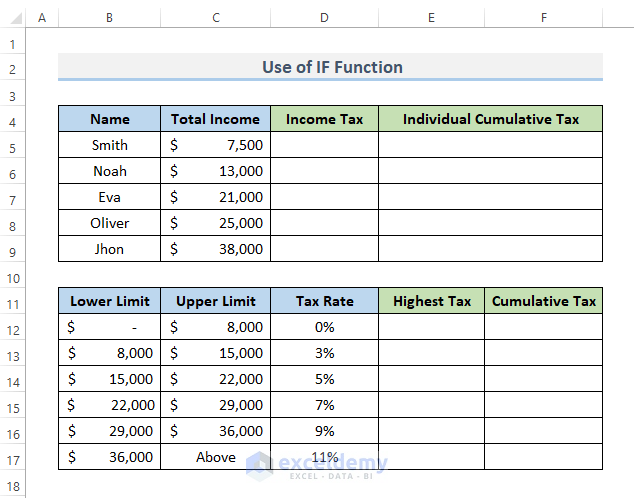

Computation Of Income Tax Format In Excel For Companies Exceldemy

How To Calculate Income Tax In Excel

Filing Income Tax Returns Key Questions Answered Youtube

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Computation Of Income Tax Format In Excel For Companies Exceldemy

How To Calculate Income Tax In Excel

How To File Income Tax Return Ay 2021 22 On New Income Tax Portal For Salaried Person Itr 2021 22 Youtube