2022-5-26As the new financial year FY 2022-23 begins from April 1 several income tax and financial changes will come into effect. 2 days agoIncome Tax Slab.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

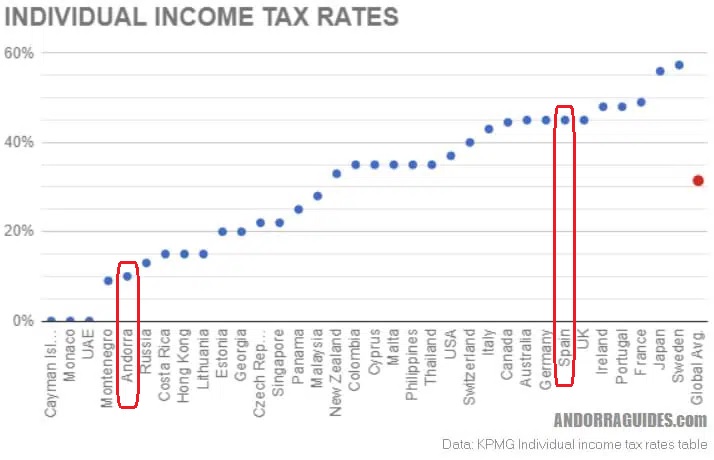

2022-10-17A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

. The list focuses on the main types of taxes. Find Out Which Taxable Income Band You Are In. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

Under certain circumstances it is possible to defer the taxation of gains up to a certain amount from selling a private real property when a new private real property house or apartment is bought either in Sweden or the EUEuropean Economic Area. Enterprises engaging in prospecting exploration and exploitation of mineral resources eg. For property disposed within 3 years.

The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. Application of sections 60 and 60A to a takaful business. The 2022 budget.

Corporate tax in 2010 is 19. 2022-10-17Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15. 100 USD 5000 PHP 3 Estimated values.

According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the. The Personal Income Tax Rate in Finland stands at 5695 percent. Personal Income Tax Rate in Finland averaged 5352 percent from 1995 until 2020 reaching an all time high of 6220 percent in 1995 and a record low of 49 percent in 2012.

Malaysia Corporate Income Tax Rate. Malaysia adopts a territorial system of income taxation. Individuals may carry forward business losses indefinitely.

Theres even a tax relief for alimony payments. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance. The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves.

2022-10-7He said the income tax rate of resident individuals will be reduced by two percentage points for the range of taxable income between RM50000 and RM100000. 2022-7-28The standard corporate income tax CIT rate is 20. Corporate tax individual income tax and sales tax including VAT and GST and capital gains.

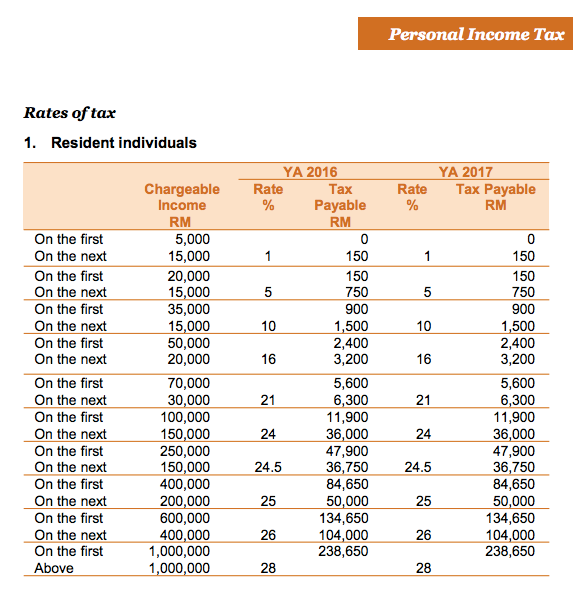

But keep in mind the overall audit rate is low. 2022-9-8This tax is 5 of the excess of the total net taxable income over USD 500000 limited to 33 of their personal and dependents exemption plus USD 8895. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. For the full list of personal tax reliefs in Malaysia as of the. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007.

Only certain taxpayers are eligible. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. Check Income Tax Slabs Tax Rates in india for FY 2021-22 AY 2023-24 on ET Wealth.

The Personal Income Tax Rate in Sweden stands at 5290 percent. Personal Income Tax Rate in Sweden averaged 5554 percent from 1995 until 2021 reaching an all time high of 6140 percent in 1996 and a record low of 3230 percent in 2020. Typical deductions are repairs and maintenance depreciation and taxes and licenses.

How Does Monthly Tax Deduction Work In Malaysia. 2021-3-25The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Chargeable income reduced rate and exempt dividend.

Enterprises operating in the oil and gas industry are subject to CIT rates ranging from 32 to 50 depending on the location and specific project conditions. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 2022-7-20A tax rate of 22 applies to the sale of private real property and tenant owners apartments.

2022-7-14The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. On the First 10000 Next 10000. 2022-6-252 Exchange rate used.

2022-8-20A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Investment income - Interest income received by individuals from monies deposited in approved institutions is exempt from tax. On the First 2500.

A company whether resident or not is assessable on income accrued in or derived from Malaysia. Income-generating expenses are deductible when calculating taxable income. Leaving Malaysia without payment of tax.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Additional time commitments outside of class including homework will vary by student. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

Alternate basic tax ABT In addition to the regular income tax individuals are required to compute an ABT assessed in accordance to the below tax table. This page provides - Sweden Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. 4 Rental income earned by nonresident individuals is taxed at progressive income tax rates.

Situations covered assuming no added tax complexity. We provide a list of such changes applicable from April 1 2022. The surcharge is applicable.

On the First 5000 Next 5000. 2022-3-14These Are The Personal Tax Reliefs You Can Claim In Malaysia. Silver gold gemstones are subject to.

First the taxable range of RM50000 to RM70000 rate is lowered by 13 per cent to 11 per cent and secondly the income range of more than RM70000 to RM100000 is lowered from 21 per. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN. Cess is levied at the rate of 4 on the income tax payable.

This page provides - Finland Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability. From 1 January 2019.

Heres How A Tax Rebate Can Help You Reduce Your Tax Further. 2009-6-26INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. 2022-3-8Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Calculations RM Rate TaxRM 0-2500. Malaysia unveiled a leaner budget of RM3723 billion US8006 billion for 2023 on Friday Oct 7 amid an uncertain global environment and an expected slow growth. 2 days agoThe economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP.

Discover latest income tax slab rates new regime and old regime updates as per the union budget Income tax slabs rates announcements videos and more. 2022-10-17The Czech income tax rate for an individuals income in 2010 is a flat 15 rate. Malaysia Personal Income Tax Rate.

However a real property gains tax RPGT has been introduced in 2010.

Impacts Of The Self Assessment System For Corporate Taxpayers

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

Malaysian Bonus Tax Calculations Mypf My

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Individual Income Tax In Malaysia For Expatriates

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Learning From Andorra S Tax System International Liberty

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

7 Tips To File Malaysian Income Tax For Beginners

Entity Country Legal Form Activity Income Before Taxes Income Tax Rate Dividend Withholding Tax Rate Net Dividend Received By Parent A Bahrain Branch Course Hero

Pdf Asean Tax Malaysia Asd Dsa Academia Edu

Malaysia Personal Income Tax Rate 2022 Take Profit Org

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium